In the dynamic world of global finance, this week’s data offers a nuanced picture of a world in transition. Our Global Macro & Market Watch reveals a cautious shift by major central banks, including the US Federal Reserve and the Bank of England, toward more accommodating monetary policies. Simultaneously, key economies like Japan and the Eurozone are finding stable ground amid cooling inflation and steady output. Meanwhile, China’s post-reopening recovery appears to be losing some steam, signaling underlying challenges. Against this global backdrop, India continues to shine, bolstered by a constructive domestic outlook, strong reserve growth, and a significant sovereign credit rating upgrade, cementing its position as a key driver of global economic momentum.

🇮🇳 India: Reserves Rise, Reforms in Motion

India’s economic signals this week leaned constructive. Wholesale prices ticked up 0.52% YoY in August, reversing July’s 0.58% fall, while unemployment eased slightly to 5.1%. The merchandise trade deficit narrowed to $26.5 billion, compared to $29.7 billion a year ago, showing resilience despite global demand challenges.

External strength was highlighted as forex reserves climbed to $702.9 billion, up $4.7 billion from the previous week. Supporting confidence further, Japan’s credit rating agency – Rating & Investment Information (R&I) upgraded India’s sovereign rating to BBB+ with a stable outlook, citing demographics, strong demand, and policy stability.

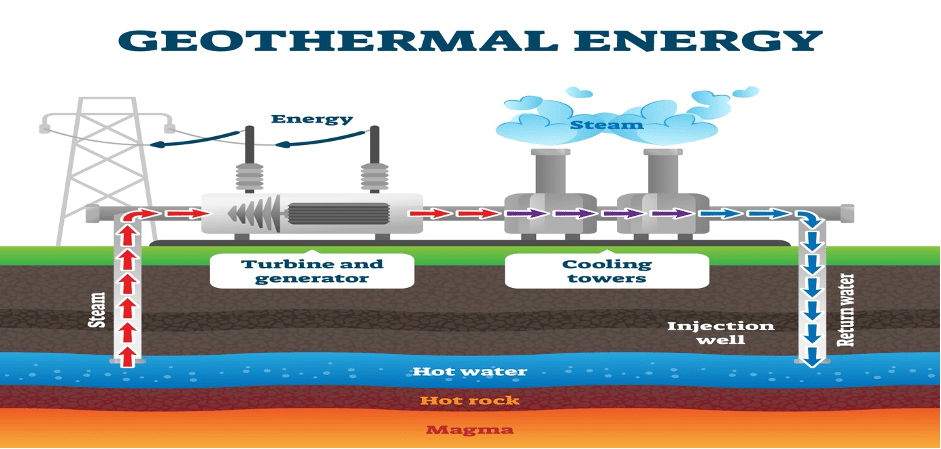

Government momentum continued with ₹36,000 crore of new projects in Bihar, railway expansion in Maharashtra, and major industrial approvals in Odisha (₹4,739 crore) and MoUs worth ₹80,962 crore in Maharashtra. On the policy front, India unveiled its first geothermal energy policy, pushed clean steel initiatives, and scaled up renewable capacity by 23 GW in just 5 months.

Regulatory highlights:

- RBI urged banks to cut fees on debit cards & late payments.

- SEBI simplified processes for FPIs, REITs, and Social Stock Exchange participation.

- IRDAI launched the Bima Sugam insurance portal.

- PFRDA introduced a Multiple Scheme Framework for NPS and proposed new withdrawal rules.

- The Ministry of Finance also revised the GST rate framework, effective September 22.

Investor view: Rising reserves and reforms strengthen India’s long-term case. Equities in infrastructure, renewables, financials, and tourism look supported, while bond investors may prefer short-duration strategies as inflation remains sticky.

🇺🇸 United States: First Rate Cut Since 2023

The Fed cut the funds rate by 25 bps to 4.00%–4.25%, marking its first easing in nearly two years. The move followed mixed economic prints:

- Retail sales up 5% YoY in August (vs 4.1% prior), showing robust consumer demand.

- Industrial production rose 0.9%, though manufacturing momentum stayed muted.

- Housing showed strain with starts down 8.5% and permits falling 3.7%.

- Sentiment diverged: Empire State index at -8.7, while Philadelphia Fed jumped to 23.2.

- Jobless claims fell to 231,000, a sharp drop from the prior week’s 264,000.

Investor view: Lower rates should boost equity multiples, particularly in consumer discretionary and housing-linked sectors, though real estate fundamentals remain weak. Global slow demand continues to remain a challenge. In fixed income, intermediate Treasuries and TIPS look attractive under a dovish Fed.

🇪🇺 Eurozone: Output Gains, Inflation Anchored

Industrial production rose 1.8% YoY in July, while construction output expanded 3.2%, signaling steady activity. The ZEW sentiment index improved to 26.1, reflecting optimism among investors. Inflation held at 2.0% headline and 2.3% core in August, providing policy breathing space. However, the trade surplus narrowed to €12.4 bn (vs €18.5 bn last year), highlighting softer external demand.

Investor view: Domestic resilience supports industrials, infrastructure, and financials. Bonds benefit from stable inflation—quality Euro debt should be preferred while avoiding excess duration.

🇬🇧 United Kingdom: Inflation High, Confidence Slips

UK inflation stayed elevated at 3.8% in August, though core eased to 3.6%. Unemployment was steady at 4.7%, but consumer confidence dipped to -19 in September. On the positive side, retail sales grew 0.7% YoY, supported by services activity. The BoE voted 7–2 to hold rates at 4%, with two members favouring a 25-bp cut.Investor view: A mixed environment favours defensive equities in services and construction, while gilt investors may consider short-duration positioning ahead of potential rate cuts.

🇯🇵 Japan: Inflation Cools, Trade Gap Narrows

Japan’s inflation eased to 2.7% in August, the lowest since late 2024, while core matched at 2.7%. The BoJ kept rates at 0.5%, maintaining its highest level since 2008. External balances improved as the trade deficit shrank to JPY 242.5 bn, nearly two-thirds lower than last year. But machinery orders slumped 4.9% in July, underlining weak industrial appetite.Investor view: Softer inflation allows policy flexibility, but weaker capex clouds growth. Equities tied to domestic consumption and financials appear better positioned than exporters. Shorter JGBs and inflation-linked bonds should remain the bond play for investors.

🇨🇳 China: Recovery Momentum Loses Steam

Industrial production slowed to 5.2% YoY in August (vs 5.7% in July), while retail sales growth eased to 3.4%. The surveyed unemployment rate edged up to 5.3%, signalling rising labour market stress.

Investor view: Caution warranted—broad consumption remains soft. Structural themes like EVs, renewables, and policy-supported infrastructure continue to offer selective opportunities. In fixed income, stick to quality issuers while avoiding long-duration.

🧭 Cross-Market Strategy Snapshot

| 🇺🇸 US | Consumer, housing-sensitive, defensives | TIPS, intermediate Treasuries |

| 🇯🇵 Japan | Domestic consumption, financials | Short-duration, inflation-linked JGBs |

| 🇨🇳 China | EVs, infra, renewables, consumer tech | Avoid long-duration; rotate to quality |

| 🇪🇺 Eurozone | Industrials, infra, financials | Quality Euro bonds; avoid duration risk |

| 🇬🇧 UK | Services, construction | Short-duration gilts |

| 🇮🇳 India | Infra, renewables, BFSI, tourism | Short-duration bonds; inflation-watch |

✍️ Millionsworth Takeaway

This week’s pulse reinforces a world in transition. Central banks are cautiously turning dovish, Europe and Japan are finding stability, while China’s recovery shows cracks. India, meanwhile, continues to shine with reform momentum, stronger reserves, and a credit rating upgrade. For investors, the path forward demands selectivity, agility, and disciplined allocation. At Millionsworth, we help you cut through the noise and position for what’s next.