The first week of November 2025 highlighted a divergence in the global economic landscape. While service sectors in the U.S. and Eurozone showed surprising resilience, manufacturing activity remained subdued, particularly in Asia. Markets contended with a weaker-than-expected U.S. jobs report and growing dovish sentiment at the Bank of England, suggesting the “higher for longer” rate environment is being severely tested.

In India, the focus was intensely on domestic policy momentum. A flurry of regulatory updates signalled a clear push towards strengthening market frameworks, enhancing transparency, and improving the ease of doing business.

India: Resilience Amid Regulatory Overhaul

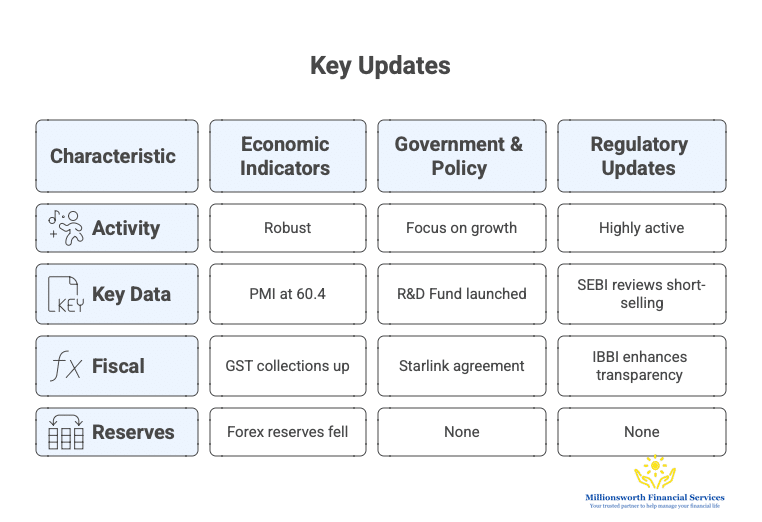

India’s economy continued to display robust fundamentals, supported by a proactive policy and regulatory environment.

- Economic Indicators: Economic activity remained robust, with the HSBC Composite PMI at 60.4 despite a slight moderation in services. GST collections rose 4.6% (YoY) to Rs 1.96 lakh crore, providing fiscal comfort. However, foreign exchange reserves fell by $5.6 billion to $689.73 billion in the week ended October 31.

- Government & Policy: The government underscored its focus on long-term growth and technology. Key moves included the launch of a Rs 1 lakh crore Research, Development, and Innovation Fund and Maharashtra’s pioneering agreement with Starlink to enhance rural connectivity.

Regulatory Updates: Regulators were highly active, with SEBI announcing a comprehensive review of short-selling rules and new anchor investor norms to boost domestic participation. Separately, the IBBI (Insolvency and Bankruptcy Board of India) moved to enhance transparency in insolvency bids by proposing mandatory beneficial ownership disclosures.

🌎 Global Updates

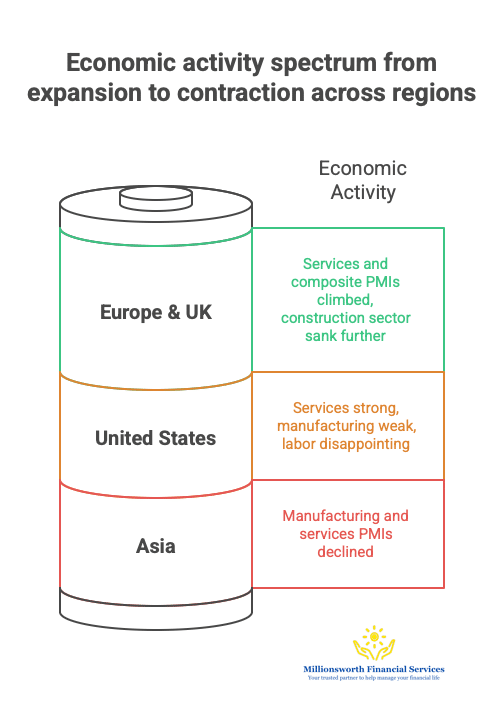

United States: The U.S. economy presented a mixed and confusing picture. The services sector showed strong expansion, with the ISM Services PMI rising to 52.4 and the S&P Global Services PMI hitting 54.8. However, the labor market disappointed significantly, adding only 42,000 jobs in October. Manufacturing data was split: the ISM index remained in contraction at 48.7, while the S&P Global PMI showed expansion at 52.5.

Europe & UK: The Eurozone economy showed tentative signs of improvement, with Services and Composite PMIs climbing to 53.0 and 52.5, respectively. Retail sales also rose 1.0% (YoY) in September. However, the construction sector sank further, with the PMI dropping to 44.0. In the UK, the Bank of England held its rate at 4%, but a narrow 5-4 vote—with four members favouring a rate cut—signalled a significant dovish pivot.

Asia: Economic activity in Asia appeared to be slowing. China’s trade surplus missed expectations, coming in at $90.07 billion, while its manufacturing and services PMIs both declined. In Japan, household spending growth eased to 1.8% (YoY), and its manufacturing sector remained in contraction (PMI at 48.2).

🧭 Millionsworth View

Equity Market: Global equity markets faced a sharp “risk-off” correction this week, spearheaded by a major sell-off in U.S. technology and AI stocks, with the Nasdaq recording its biggest weekly decline in months due to profit-taking and valuation concerns. This move completely overshadowed signs of potential relief, such as the weak U.S. jobs report and the dovish 5-4 split at the Bank of England, which had fuelled hopes that the global tightening cycle is nearing its end. In contrast, the foundation of the Indian market remains structurally sound, supported by robust domestic fundamentals like strong PMI and GST collections.

While the Nifty and Sensex recorded mild losses due to continuous Foreign Institutional Investor (FII) selling that mirrored the global fear, this was met by resilient buying from Domestic Institutional Investors (DIIs). We view this FII-driven dip as a potential opportunity for serious investors to continue systematic investments (SIPs) in quality Indian assets, leveraging the nation’s independence from global volatility for long-term compounding.

Debt Market: The global debt market received a bullish signal this week. The very weak U.S. job creation and the BoE’s narrow “hold” vote solidified market expectations that global central bank policy has pivoted from hiking to an extended pause, with cuts on the horizon. This sent yields lower. In India, G-Sec yields remain stable, supported by strong domestic demand. The RBI’s significant net short position in FX forwards (at $59.4 billion as of September-end) indicates active currency management to prevent volatility. With global yields potentially easing, the environment for Indian debt remains favourable for investors looking to lock in yields.

Commodities (Gold & Silver): Precious metals are likely to find strong support in the current environment. The weak U.S. jobs report and the dovish tilt from the Bank of England are highly bullish for non-yielding assets like gold and silver, as they bolster expectations for future rate cuts and a potentially weaker dollar. This monetary policy outlook, combined with persistent geopolitical uncertainty, underpins the strategic case for holding precious metals as a portfolio hedge against inflation and market volatility.

The week’s economic data reinforces a narrative of a complex and divergent “soft landing.” Resilience in Western service sectors is being tested by weak manufacturing and cooling labor markets, putting pressure on central banks to ease policy. For India, the story remains one of domestic strength, with a clear focus on structural reforms to build a resilient, high-growth economy.The Global Economic Landscape underscores a transition toward a “soft landing,” where Western services hold up but manufacturing slows, forcing central banks to pivot. For investors, this calls for balance: leverage India’s structural growth while using precious metals as a hedge against global volatility.