India’s Disinflation Sparks Optimism, While Global Growth Remains Uneven in the Global Economic Landscape

The global economic landscape this week reflected a clear divergence among major economies. India’s sharp disinflation has set the stage for a possible rate cut and a supportive growth cycle, while the Eurozone and UK grapple with stagnation and persistent inflation. The United States showed mixed signals—manufacturing revived even as small business sentiment softened. Meanwhile, Asia’s powerhouses, China and Japan, continued to confront slowing industrial activity and deflationary pressures. Together, these developments define a cautiously optimistic yet uneven global market outlook for investors.

🇮🇳 India: Cooling Inflation Strengthens the Case for Monetary Easing

India was at the center of attention as both CPI (1.54%) and WPI (0.13%) inflation fell sharply, confirming strong disinflationary momentum. This gives the Reserve Bank of India (RBI) significant room to adopt a dovish policy stance, a view reinforced by the Governor’s statement about “room for a further rate cut.” The IMF’s upward revision of India’s GDP forecast to 6.6% added confidence to the growth outlook. However, a widening trade deficit ($32.15 billion) and a slight dip in forex reserves could exert pressure on the rupee. Government actions such as expanded EPFO withdrawal norms and initiatives to boost domestic manufacturing of Rare Earth Minerals and Vande Bharat trains highlight a continued focus on demand and supply-side reforms.

Investment Takeaways:

- Debt Market: A dovish RBI and low inflation environment favor long-duration bond funds for potential price appreciation.

- Equity Market: Bullish outlook on rate-sensitive sectors such as Financials, Real Estate, and Autos.

- Commodities & Currency: Rupee caution persists; Gold and Silver remain valuable portfolio diversifiers—Silver benefits from industrial demand and rupee depreciation.

🇪🇺🇬🇧 Eurozone & UK: Growth Slows, Inflation Persists

Economic data from the Eurozone and United Kingdom pointed to a slowdown in growth amid stubborn price pressures. The Eurozone’s CPI rose slightly to 2.2%, while industrial production weakened. In the UK, GDP growth eased to 1.3%, manufacturing contracted, and unemployment rose to 4.8%.

This combination of sluggish growth and firm inflation signals a stagflationary environment, limiting policy flexibility for both the European Central Bank (ECB) and the Bank of England.

Investment Takeaways:

- Equity: Underweight cyclical and consumer-discretionary sectors due to stagflation risk.

- Debt: Persistent inflation keeps bond yields elevated, capping prospects of policy easing.

- Commodities: Gold gains appeal as a hedge against regional risks; Silver faces headwinds from weak industrial demand.

🇺🇸 United States: Manufacturing Rebounds, Small Businesses Cautious

The US economy presented a mixed but resilient outlook. The NY Empire State Manufacturing Index jumped to 10.7in October, marking a strong recovery in manufacturing sentiment. However, the NFIB Small Business Optimism Indexdipped slightly to 98.8, indicating cautious confidence among small enterprises—the backbone of the US economy.

The data underscores a two-speed recovery—large-scale manufacturers are gaining momentum while smaller businesses remain conservative about hiring and investment.

Investment Takeaways:

- Equity: Positive for global markets and exporting economies such as India’s IT and manufacturing sectors.

- Debt: Strong manufacturing may delay US Fed rate cuts, keeping short-term yields supported.

- Commodities: Silver benefits from robust industrial activity; Gold may face reduced demand as safe-haven interest cools.

🇨🇳 China: Deflation and Weak Credit Growth Persist

China’s latest data reinforced concerns over soft domestic demand. Inflation eased to 0.3%, Producer Prices declined 2.3%, and loan growth slowed to 6.6%, indicating both deflationary pressures and weak credit expansion. Even the trade surplus narrowed to $90.45 billion, showing a moderation in external demand.

Investment Takeaways:

- Equity: Bearish for cyclical sectors like property and banking amid shrinking credit demand.

- Debt: The deflationary trend opens space for the People’s Bank of China (PBoC) to inject liquidity and cut rates—positive for Chinese bonds.

- Commodities: Industrial metals face downside risk, while Gold gains mild support as a global hedge.

🇯🇵 Japan: Industrial Activity Contracts Further

Japan’s Machinery Orders slowed to 1.6%, and Industrial Production fell 1.6%, highlighting weaker business sentiment and investment appetite. The data indicates falling export demand and constrained domestic production.

Investment Takeaways:

- Equity: Negative for exporters and cyclical manufacturing stocks.

- Debt: The Bank of Japan (BoJ) is likely to maintain its ultra-loose stance, keeping Japanese Government Bonds (JGBs) supported.

- Commodities: Silver remains under pressure, while Gold benefits from yen weakness and global uncertainty.

Summary:

The global investment landscape remains defined by disinflation in India, manufacturing resilience in the US, and industrial slowdown across East Asia. Investors should stay diversified, balancing growth opportunities with defensive assets amid shifting inflation and policy dynamics.

⚖️ Contrarian View: The Risks Behind the Calm

While markets are celebrating India’s cooling inflation and the US’s manufacturing rebound, the underlying global slowdown—driven by weakening demand in China, Japan, and Europe—poses a medium-term risk to trade-linked growth. If global consumption softens further, even India’s domestic resilience may face external pressure.

Additionally, premature monetary easing in emerging markets could risk re-igniting inflation later in 2026 if commodity prices rebound. Thus, investors should remain selectively optimistic—favoring long-duration debt and quality equities, while maintaining exposure to Gold and Silver for portfolio balance.

💡 Conclusion

Balanced positioning remains key as inflation cools, but uncertainty lingers.

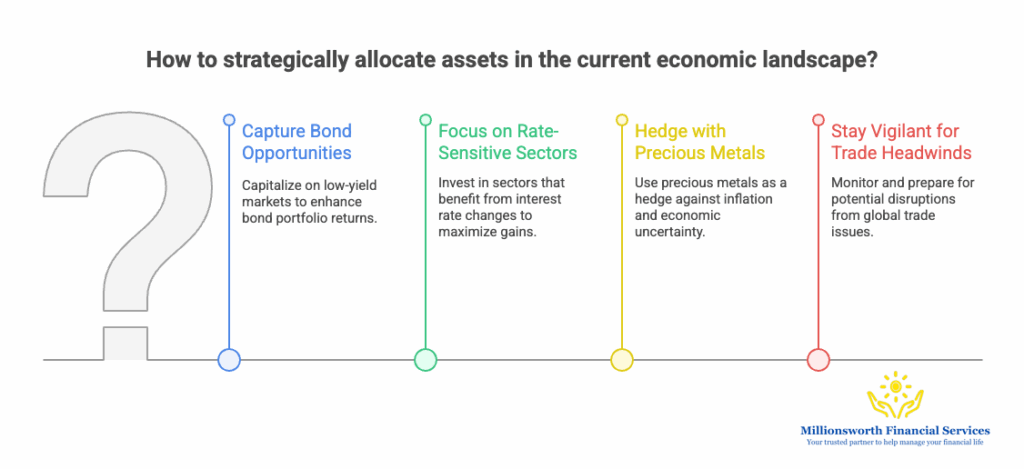

The global economic landscape is entering a phase of policy transition—India leans toward easing, the US stays data-dependent, and Asia battles deflation. For investors, this environment calls for strategic asset allocation: