Time to Read: 5 Minutes

Post Date: 28th December 2025

Written By: Vinod Prajapati, CFP

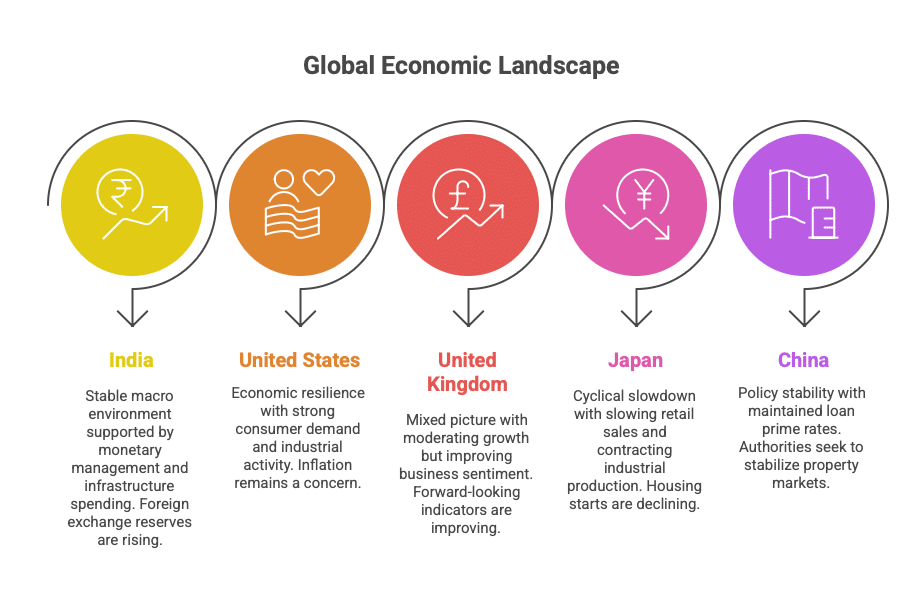

As we approach the close of 2025, the Global Economic Landscape reflects a nuanced transition phase—where growth resilience, regulatory recalibration, and liquidity management dominate policymaker priorities. The final full trading week of December delivered a mix of stabilising macro signals from India, selective strength in the US economy, and growing evidence of cyclical slowdown in Japan, while China continues to anchor growth through policy continuity.

This week’s developments reinforce a broader theme visible across recent months: policy-driven stability rather than policy-driven stimulus, with governments and central banks attempting to balance growth, inflation credibility, and financial system efficiency.

India: Liquidity Support, Infrastructure Push, and Market Reforms

India’s macro environment remains stable, supported by prudent monetary management and targeted infrastructure spending. The Reserve Bank of India reported a USD 4.36 billion rise in foreign exchange reserves to USD 693.32 billion, reinforcing external resilience amid uneven global capital flows.

Economic activity showed early signs of stabilisation, with eight core infrastructure sectors expanding 1.8% year-on-year in November, reversing October’s contraction. While growth remains modest, the recovery in core sectors indicates a gradual improvement in underlying momentum.

Policy efforts continued to focus on long-term efficiency. Approval of new metro corridors, mining sector reforms, and steps toward asset monetisation highlight the government’s infrastructure-led approach. Meanwhile, the RBI’s planned ₹2.90 lakh crore liquidity infusion aims to ease tight money market conditions without shifting the broader policy stance. SEBI’s recent market reforms further support investor participation and operational efficiency.

United States: Growth Resilience with Inflation Watchfulness

US macro data during the week continued to surprise on the upside, reinforcing the narrative of economic resilience even as inflation remains sticky.

The US economy expanded at an annualised rate of 4.3% in Q3 2025, up from 3.8% in Q2, reflecting strong consumer demand and steady industrial activity. Industrial production rose 2.5% year-on-year in November, while manufacturing output grew 1.9%, highlighting continued momentum in the real economy.

Labour market conditions remained tight, with initial jobless claims declining to 214,000, underscoring employment stability. However, inflationary pressures have not fully receded. Personal Consumption Expenditure (PCE) prices increased at an annualised 2.8% in Q3, higher than the previous quarter’s 2.1%.

Regional manufacturing sentiment showed improvement as well, with the Richmond Fed Manufacturing Index rising to -7 from -15, suggesting contraction is moderating.

For global markets, the implication is clear: while rate cuts may still be on the table in 2026, the US Federal Reserve is unlikely to rush, given the combination of strong growth and lingering inflation pressures.

United Kingdom: Confidence Improving, Growth Moderating

The UK economy presented a mixed but stabilising picture. Economic growth moderated slightly, with GDP expanding 1.3% year-on-year in Q3, marginally lower than Q2. However, business sentiment improved meaningfully, with business confidence rising to 47% in December, its highest level this year.

This divergence suggests that while headline growth has softened, forward-looking indicators are improving—potentially laying the groundwork for a more constructive outlook in early 2026.

Europe remained relatively quiet during the holiday-shortened week, with no major macroeconomic releases or policy signals from the ECB, keeping the region largely absent from global market drivers.

Japan: Clear Signs of Cyclical Slowdown

Japan emerged as the weakest link among major developed economies this week. Retail sales growth slowed to 1.0%, while industrial production contracted by 2.1% year-on-year in November, reversing the previous month’s expansion. Housing starts declined sharply by 8.5%, indicating stress in domestic demand and construction activity.

Despite improvements in coincident and leading economic indices earlier in the quarter, the latest data points suggest that Japan’s exit from ultra-loose monetary conditions is beginning to weigh on growth momentum.

China: Policy Stability Over Aggression

China’s central bank, the People’s Bank of China, maintained its one-year and five-year Loan Prime Rates at 3.0% and 3.5% respectively, extending its policy pause for the seventh consecutive month. The decision reflects a preference for measured support rather than aggressive easing, as authorities seek to stabilise property markets while avoiding financial excesses.

What This Means for Investors

From an investment perspective, the Global Economic Landscape at year-end 2025 highlights three clear themes:

- Equity Investors: India continues to benefit from structural reforms, infrastructure spending, and regulatory clarity, while US equities remain supported by earnings resilience. However, elevated valuations warrant selective and disciplined positioning rather than aggressive risk-taking.

- Fixed Income Investors: Liquidity support from the RBI and stable policy rates globally create opportunities in high-quality duration strategies. Investors should focus on accrual and carry while remaining cautious on credit risk.

- Commodity Investors: As of late December 2025, both gold and silver are trading at historic record highs, offering a dual opportunity for growth and capital preservation—but requiring disciplined, non-emotional entry strategies. Silver’s rally to $70–$79/oz (₹2,15,000/kg) is driven by structural supply deficits and rising demand from AI and solar applications, while gold’s move above $4,500/oz (₹1,40,000/10g) is anchored by central bank accumulation, a weakening US dollar, and geopolitical uncertainty.

Despite optimistic 2026 targets of $100/oz for silver and $5,000/oz for gold, both metals currently appear overbought, making lump-sum investments risky. Investors should therefore maintain balanced exposure—5–10% in silver for offensive growth and 10–15% in gold for defensive stability—using staggered investments or SIPs to manage volatility and smooth entry costs.

Conclusion

As 2025 draws to a close, the Global Economic Landscape reflects cautious optimism rather than exuberance. Policymakers are prioritising stability, liquidity management, and structural reforms over headline stimulus. For investors, this reinforces the importance of process-driven asset allocation, diversification, and long-term discipline over short-term market narratives.

The coming quarters will test how effectively global economies can transition from policy support to self-sustaining growth—without reigniting inflation or financial instability.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult with a financial advisor before making investment decisions.