The Global Economic Landscape in the penultimate week of 2025 highlights a clear divergence in growth momentum and monetary policy across regions. While some economies are easing financial conditions to support slowing growth, others are tightening or holding rates steady to anchor inflation expectations. This uneven macro environment continues to influence global capital flows, currency movements, and investor sentiment.

Below is a country-wise analysis of key economic data and what it means within the broader Global Economic Landscape:

India: Stability Amid Global Uncertainty

India’s domestic macro indicators reflected consolidation and resilience during the week. The merchandise trade deficit narrowed to USD 24.53 billion in November, supported by stronger export performance. As a result, foreign exchange reserves increased by USD 1.68 billion to USD 688.94 billion. Wholesale Price Index (WPI) inflation declined by 0.32%, indicating easing input costs, while the HSBC Flash Manufacturing PMI moderated to 55.7, remaining firmly in expansion territory. The labour market also improved, with the unemployment rate falling to 4.7% from 5.2%.

These data points suggest that India is entering 2026 with a stable macro foundation. Easing inflation and a strong external buffer provide policymakers with flexibility, while steady employment supports domestic consumption. Within the Global Economic Landscape, India continues to stand out as a relatively resilient economy, supported by structural reforms and favourable demographics, even as global growth remains uneven.

United States: Cooling Inflation, Mixed Growth Signals

In the United States, inflationary pressures continued to ease, with annual inflation declining to 2.7% in November. Employment data showed mixed signals, as job creation rebounded to 64,000, while the unemployment rate edged higher to 4.6%. Consumer demand remained strong, with retail sales rising by 3.5% in October. However, manufacturing activity weakened further, reflected in the Kansas Manufacturing Production Index slipping to -3.

The US economy is showing signs of a controlled slowdown rather than a sharp downturn. Strong consumption continues to support growth, but persistent weakness in manufacturing highlights sectoral imbalances. In the broader Global Economic Landscape, the US remains a key driver of global risk sentiment, with its soft-landing trajectory playing a critical role in shaping capital flows and market volatility.

United Kingdom: Shift Towards Monetary Easing

The UK economy prompted policy action during the week, as the Bank of England cut the Bank Rate by 25 basis points to 3.75%. This decision followed a moderation in inflation, with annual consumer price inflation slowing to 3.2%. Consumer confidence remained weak at -17, reflecting ongoing cost-of-living pressures, while retail sales posted a modest growth of 0.6%.

The rate cut marks the beginning of a supportive policy phase aimed at cushioning economic slowdown. However, fragile consumer sentiment suggests that recovery may be gradual. Within the Global Economic Landscape, the UK’s move toward easing adds to the growing divergence in monetary policy, reinforcing the need for region-specific economic and investment analysis.

Eurozone: External Strength, Domestic Weakness

The Eurozone presented a mixed economic picture. The European Central Bank maintained its main refinancing rate at 2.15%, opting for policy stability amid uncertain growth prospects. On the external front, the trade surplus widened significantly to EUR 18.4 billion, driven by stronger exports. In contrast, industrial activity weakened, with the Flash Manufacturing PMI falling to 49.2, indicating contraction.

This divergence between external strength and domestic industrial weakness highlights structural challenges within the region. While exports are providing temporary support, subdued manufacturing activity could constrain medium-term growth. In the context of the Global Economic Landscape, the Eurozone remains vulnerable to both internal inefficiencies and external demand shocks.

Japan: A Historic Policy Transition

Japan took a historic step in its monetary policy journey, as the Bank of Japan raised its short-term interest rate to 0.75%. Inflation remained stable at 2.9%, supporting the central bank’s decision to continue normalising policy after decades of ultra-loose financial conditions.

This shift signals confidence in Japan’s ability to sustain inflation without extraordinary stimulus. However, higher rates could gradually affect domestic demand and borrowing. Within the Global Economic Landscape, Japan’s transition marks a significant structural change, with implications for global bond markets, currency movements, and cross-border capital flows.

China: Uneven Recovery and Weak Domestic Demand

China’s economic recovery remained inconsistent. New home prices declined by 2.4% year-on-year, underscoring continued stress in the property sector. Consumer demand stayed subdued, with retail sales growing by only 1.3%, while industrial production expanded by 4.8%, supported by manufacturing and exports.

These trends highlight the imbalance between supply-side strength and weak domestic consumption. Persistent property sector challenges and cautious consumer behaviour continue to weigh on growth. In the broader Global Economic Landscape, China’s uneven recovery poses downside risks to regional growth and global commodity demand.

Conclusion: What the Global Economic Landscape Means for Investors

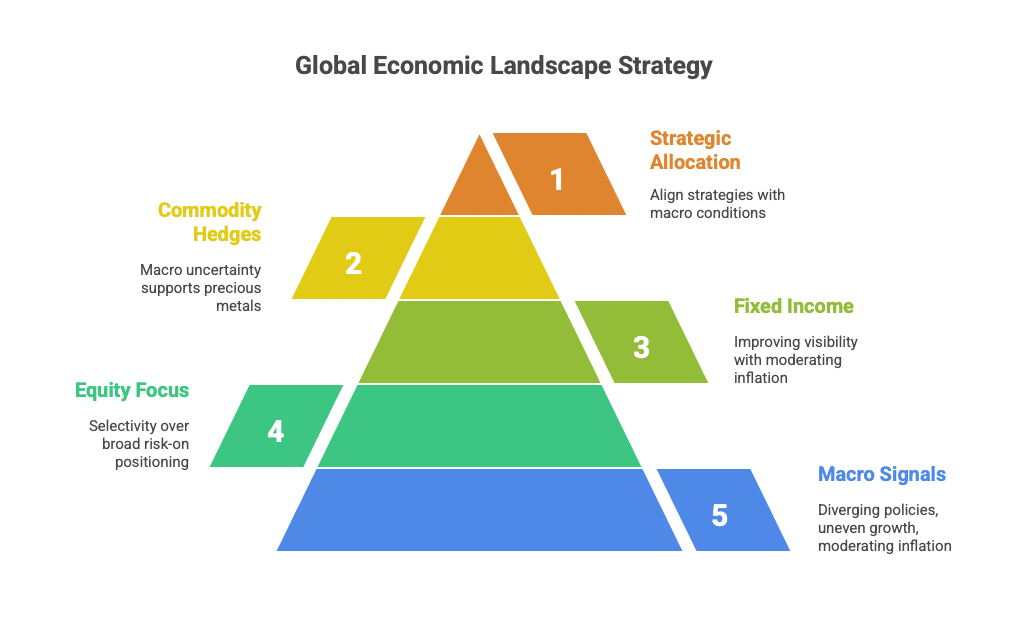

The current Global Economic Landscape presents a mixed but opportunity-rich environment for investors across asset classes. Diverging monetary policies, uneven growth trajectories, and moderating inflation trends are reshaping risk-return dynamics globally. For investors, understanding how these macro signals translate into asset-specific outcomes is critical for informed portfolio decisions.

For equity investors, the environment favours selectivity over broad risk-on positioning. India’s relative macro stability, improving external balance, easing inflation, and supportive regulatory reforms continue to strengthen the medium- to long-term equity narrative, particularly for domestically oriented sectors. In contrast, developed markets such as the US and Europe face sectoral divergence, where consumption remains resilient but manufacturing activity is under pressure. Equity investors should focus on quality businesses with strong balance sheets, pricing power, and sustainable earnings visibility, rather than relying on cyclical rebounds.

For fixed income investors, the Global Economic Landscape offers improving visibility as inflation trends moderate and rate cycles begin to diverge. The UK’s shift towards monetary easing and signs of cooling inflation in the US increase the appeal of duration in select developed markets. In India, stable inflation, a strong forex position, and regulatory initiatives to deepen bond market participation enhance the attractiveness of high-quality debt instruments. Fixed income strategies should balance accrual with selective duration exposure while remaining mindful of global rate volatility.

For commodity investors, particularly in gold and silver, macro uncertainty remains supportive. Persistent geopolitical risks, uneven global growth, and ongoing policy divergence continue to underpin demand for precious metals as portfolio hedges. While easing inflation and higher real rates in some regions may cap near-term upside, gold and silver retain their relevance as diversifiers in a fragmented Global Economic Landscape, especially during periods of market stress or currency volatility.

Overall, the Global Economic Landscape underscores the importance of disciplined asset allocation and diversification. Investors across equities, fixed income, and commodities should align their strategies with evolving macro conditions, risk tolerance, and long-term financial objectives rather than short-term market noise