December 13, 2025

7 minutes

By Vinod Prajapati, CFP

The Global Economic Landscape this week presented a study in stark contrasts, defining a period where major economies are moving in diametrically opposite directions. While the United States is choosing to look past tariff-induced inflation to save its labor market, Japan faces the unenviable task of hiking interest rates into a deepening recession. In Europe and the UK, the engines of growth are visibly sputtering, forcing a scramble for new trade alliances.

Amidst this global volatility, India stood out not just for its stability, but for its structural aggression. New Delhi utilized the week to clear the decks for massive capital inflows, pushing through long-awaited liberalizations and infrastructure commitments that signal a decisive “growth-first” agenda for 2026.

Below is our detailed interpretation of these shifts and what they mean for your portfolio.

India: Structural Reform Meets Economic Resilience

In a week where the broader Global Economic Landscape was characterized by uncertainty, India’s narrative shifted from routine maintenance to structural acceleration. The government executed a series of high-impact policy maneuvers designed to insulate the domestic economy from global shocks while aggressively courting foreign capital.

The FDI Game-Changer: The headline event was undoubtedly the Cabinet’s approval of 100% Foreign Direct Investment (FDI) in insurance firms. This is not merely a sectoral tweak; it is a macroeconomic signal. By allowing full foreign ownership, the government is inviting long-term, “patient capital” to deepen the country’s financial safety net. This move is expected to trigger a wave of consolidation and valuation re-ratings across the financial services sector, as global insurers look to capture a larger slice of the Indian market.

Pragmatism Over Geopolitics: India’s trade diplomacy also took a pragmatic turn. The approval of the India-Oman Comprehensive Economic Partnership Agreement (CEPA) and the quiet decision to fast-track business visas for Chinese nationals (cutting scrutiny time to four weeks) reveal a clear priority: economic velocity is currently superseding geopolitical rigidity. As the West builds walls, India is building bridges to ensure its supply chains remain robust and cost-effective.

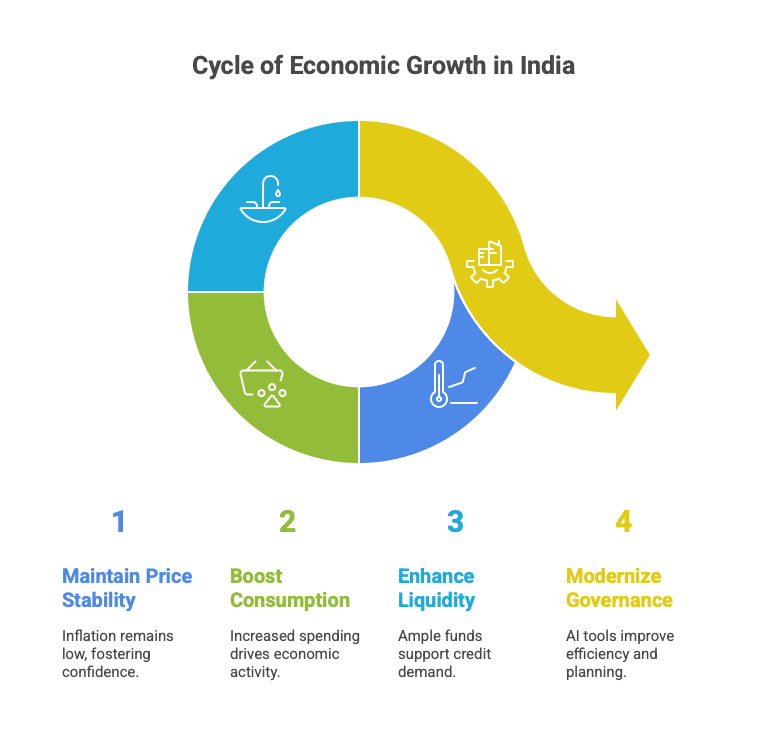

The Domestic Engine On the macro front, the data supports this bullish policy stance.

- Inflation & Growth: Retail inflation inched up marginally to 0.71% in November, a figure that remains negligible by historical standards. This price stability gave the Asian Development Bank (ADB) the confidence to upgrade India’s FY26 growth forecast to 7.2%, citing robust consumption and the lingering benefits of tax cuts.

- Liquidity Support: The RBI demonstrated its pro-growth stance by injecting Rs 500 billion into the bond market and lifting restrictions on cash credit accounts. This ensures that as credit demand picks up, the financial system has ample liquidity to fund it without spiking interest rates.

- Future-Proofing: With the Census 2027 budget cleared and new AI-driven governance tools announced for Maharashtra, the administration is effectively updating the economy’s “operating system” to handle the next decade of expansion.

United States: The Fed’s “One-Time” Inflation Bet

Across the Atlantic, the Global Economic Landscape is being reshaped by a high-stakes gamble at the Federal Reserve. This week, the Fed cut rates by another 25 basis points (bringing the target range to 3.5%–3.75%), despite inflation data showing an overshoot of their 2% target.

The Interpretation: Federal Reserve Chair Jerome Powell explicitly categorized recent price hikes as a “one-time price level adjustment” driven by tariffs, rather than persistent, demand-driven inflation. This distinction is critical for investors. By viewing tariff costs as a transitory shock, the Fed has given itself “permission” to ignore the immediate sticker shock and continue cutting rates.

Why? Because the labor market is cracking. Initial jobless claims climbed to 236,000 this week, a warning sign that high rates are starting to bite. The Fed is essentially betting that it can look through the inflation noise to prevent a recession, prioritizing employment stability over strict adherence to its inflation mandate.

China: The $1 Trillion Paradox

China’s economic data this week offered a headline-grabbing statistic: the trade surplus topped $1 trillion for the first 11 months of the year—a historic high. However, in the context of the current Global Economic Landscape, this is a sign of weakness, not strength.

The Interpretation: This record surplus is being driven by “defensive” exports. With shipments to the US shrinking due to trade barriers, Chinese factories are aggressively diverting goods to the EU and non-aligned markets. Critically, this export surge is happening because domestic demand in China has collapsed. Inflation remains anaemic at 0.7%, and producer prices are falling (-2.2%), signaling deep industrial deflation. China is effectively trying to “export its way out” of a domestic slowdown, a strategy that is exporting deflation to the world and inviting a “China Shock 2.0” in the form of retaliatory tariffs from Europe and emerging markets.

Japan: The Stagflation Policy Trap

Japan is currently navigating the most treacherous terrain in the developed world. Data confirmed that the economy shrank by an annualized 2.3% in Q3, a sharp reversal from previous growth. Yet, the Bank of Japan (BOJ) is under immense pressure to hike interest rates next week.

The Interpretation: Japan is trapped in a “stagflation-lite” scenario. The weak Yen is importing inflation (producer prices are up 2.7%), which is hurting household purchasing power more than a rate hike would. The BOJ is being forced to tighten policy into a recession—a rare and risky move intended to defend the currency rather than stimulate growth. If they miscalculate, they risk deepening the contraction significantly.

UK & Europe: Stagnation and Strategic Pivots

The European leg of the Global Economic Landscape paints a picture of fragility. The United Kingdom’s recovery engine is visibly stalling.

- UK Data: The economy grew by a tepid 1.1% in October, missing forecasts. More alarmingly, the trade deficit widened dramatically to £4.82 billion—nearly quadrupling from the previous month. This suggests the UK is suffering from a “twin drag” of slowing output and worsening trade competitiveness.

- The Euro Response: Recognizing this sluggishness, the European Union has intensified negotiations for the India-EU Free Trade Agreement. Brussels is effectively looking to external trade diplomacy to offset weak internal demand, marking a strategic pivot to high-growth markets like India to restart their economic engines.

Millionsworth View: Navigating the Global Economic Landscape

How should investors interpret these shifts? The divergence is clear: The West is fighting inflation with rate cuts, Japan is fighting it with hikes, and India is building the infrastructure to outgrow them all. This offers a specific “Safe Harbour” thesis for your portfolio.

1. For Equity Investors: The “Liberalization” Re-Rating The approval of 100% FDI in Insurance is a structural game-changer.

- Analysis: This move typically leads to M&A activity and a re-rating of the entire financial ecosystem. Global players will look to acquire stakes, driving up valuations.

- Strategy: Overweight Private Sector Banks, Insurers, and Asset Managers. These are the direct beneficiaries of foreign capital inflows. Additionally, the Infrastructure theme remains potent; with the approval of road projects in Odisha and the Census budget, government spending on physical and digital infrastructure is set to accelerate.

2. For Debt Investors: Follow the Liquidity The domestic rate cycle has decoupled from the global trend.

- Analysis: The RBI’s purchase of Rs 500 billion in bonds this week creates a “floor” for bond prices and ensures ample liquidity. The central bank is explicitly managing the yield curve to support growth.

- Strategy: This is a strong signal for medium-to-long duration funds. The RBI will not allow yields to spike, making duration plays safer. Investors should consider locking in current yields before this liquidity injection further softens rates across the curve.

3. For Commodity Investors: The “Policy Error” Hedge

- Analysis: We are in a high-risk environment. The Fed is cutting rates despite inflation (betting it’s temporary), while Japan is hiking into a recession. If either central bank is wrong, currency volatility will spike.

- Strategy: In a Global Economic Landscape defined by such policy divergence, Gold is your essential ballast. It is not just an inflation hedge; it is a hedge against “Central Bank Policy Error.” Accumulate on dips to diversify against potential volatility in the US Dollar and Yen.

Conclusion: The week ending December 13, 2025, marks a significant point of separation. While the global economy wrestles with tariffs and stagnation, India has signaled it is open for business. For investors, the strategy is to capitalize on India’s structural growth while maintaining hedges against the fragility seen in the rest of the world.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult with a financial advisor before making investment decisions.