This week’s data confirms a critical theme: The global economic landscape are increasingly defined by a divergence between a cooling West and a resilient Asia. While the US Fed nears a policy pivot, strong domestic indicators in India and stabilizing factories in China demand separate attention from investors.

India: Resilience Amidst Regulatory Overhaul 🇮🇳

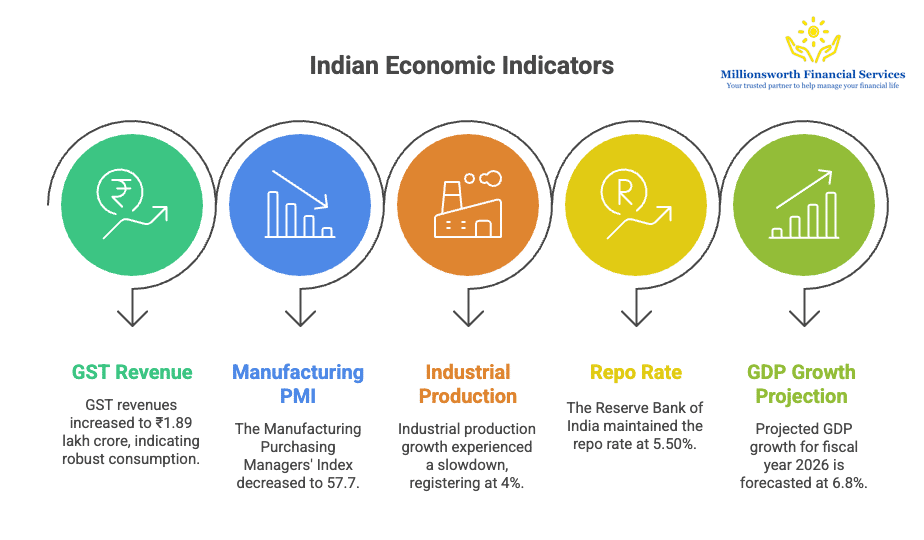

India’s consumption remains robust, evidenced by GST revenues jumping 9.1% year-on-year to ₹1.89 lakh crore in September. However, manufacturing momentum slowed, with the HSBC Manufacturing PMI easing to 57.7 (from 59.3). The RBI provided stability, unanimously holding the repo rate steady at 5.50% and projecting a strong FY26 GDP growth of 6.8% alongside low CPI inflation of 2.6%. The central government’s fiscal deficit widened to 38.1% of the budget estimate. Moody’s affirmed the sovereign rating at ‘Baa3’ with a ‘Stable’ outlook, citing strong macroeconomic fundamentals. The RBI also announced numerous regulatory changes, including a new Expected Credit Loss (ECL) framework for provisioning and proposed changes to External Commercial Borrowings (ECB) norms.

Investor Strategy:

- Equity: The strong GST figures and the RBI’s confident GDP forecast (6.8%) are powerful positives, favoring domestic-cyclical sectors and large cap stocks.

- Debt: The rate pause and low inflation projection (2.6%) suggest Indian bond yields will remain range-bound. The new ECL framework introduces potential volatility for banks’ provisioning requirements.

- Commodities: Sustained manufacturing strength (PMI > 50) underpins demand for base metals. Gold and Silver prices will follow global cues, but strong local demand keeps domestic prices resilient.

United States: Cooling Confirms Dovish Policy Path 🇺🇸

The US economy showed clear signs of cooling in September. The key ISM Services PMI fell sharply to 50.0 (from 52.0), reaching the brink of contraction. Manufacturing remains weak (ISM at 49.1), though the labor market saw a modest gain of 32,000 jobs (ADP). Regional manufacturing confirmed contraction (Dallas Fed index slipped to -8.7). Housing offered a bright spot, with Pending Home Sales rebounding 3.8%.

Investor Strategy:

- Equity: The sharp deceleration in services and job growth is often viewed positively, as it reduces the risk of aggressive rate hikes, potentially supporting overall market valuations (the “Fed Pivot” trade).

- Debt: Weak PMIs and cooling job data are highly bullish for US Treasuries. The data strengthens the case for the Federal Reserve to adopt a dovish stance, driving yields lower.

- Commodities: Slower overall growth tempers demand for industrial commodities. Crucially, the increased likelihood of a less aggressive Fed (or future cuts) weakens the US Dollar, providing a strong tailwind for Gold and Silver by lowering real yields.

Eurozone & UK: Manufacturing Drags, Stagflationary Risk 🇪🇺🇬🇧

The Eurozone’s Composite PMI rose marginally to 51.2, led entirely by the services sector (PMI 51.3). Crucially, manufacturing fell further into contraction (49.8). Inflation edged up to 2.2% annually, but significant deflationary pressures at the factory level emerged, with the PPI falling -0.6% (from +0.2%). The UK also struggled, with its Composite PMI easing to a near-stagnation level of 50.1, and manufacturing in sharp contraction at 46.2.

Investor Strategy:

- Equity: Selectivity is key. Favour defensive and services-oriented stocks in the Eurozone. The weak UK Composite PMI suggests corporate earnings risk is high.

- Debt: Mixed signals (rising CPI vs. falling PPI) suggest the ECB will remain patient. However, the weak overall growth environment increases pressure on the BoE and ECB to consider easing, which is constructive for Gilts and Eurozone bonds.

- Commodities: The sustained manufacturing contraction across both regions signals weak demand for base metals and crude oil. Gold’s safe-haven appeal may rise due to the increased risk of regional recession.

China & Japan: Divergent Asian Paths 🇨🇳🇯🇵

China’s factory sector showed stabilization, with the official NBS Manufacturing PMI rising to 49.8, nearing expansion, and the private RatingDog PMI showing solid growth at 51.2. Japan continues to struggle, with Retail Sales unexpectedly falling 1.1% and Industrial Production decreasing 1.3%—the unemployment rate also rose to 2.6%, its highest in over a year.

Investor Strategy:

- Equity: China’s stabilization is a positive signal for cyclical sectors, suggesting policy support is working. Japan’s continued weakness reinforces the Bank of Japan’s dovish policy, which helps boost export-oriented stocks via a weaker Yen.

- Debt: Expect continued monetary policy easing in China. Japan’s JGBs remain unattractive due to strict yield caps.

- Commodities:China’s recovery is the most important signal for global commodities, indicating renewed industrial demand for copper, iron ore, and Silver. Japan’s weakness means its contribution to global demand will remain muted.

Millionsworth’s Perspective ✍️

Equities: Asia is emerging as the bright spot—India’s strong consumption and China’s manufacturing stabilization stand out against Western slowdown. Global Equity Investors may recognize the fundamental performance gap and consider rotating capital toward high-growth Asian markets (India, China) which are backed by strong domestic demand and central bank support while being selective in Western markets.

Bonds: The data is unambiguously positive for Western sovereign debt. Cooling US and UK PMIs increase the chances of future interest rate cuts, which pushes bond prices higher, drives yields down and increases the returns for existing investor. Indian bonds stay range-bound.

Precious Metals: The combination of a weaker US economy and lower future rate hikes makes Gold attractive as a hedge against a weaker US Dollar and lower real yields. Silver gets a double boost: from the dovish monetary outlook and from the stabilizing industrial demand out of China.