Welcome back to our weekly analysis of the global economic landscape. Last week, we tracked simmering trade tensions. This week, the story is one of surprising divergence: a dramatic inflation cooldown in India contrasted sharply with a resilient American consumer and a deepening slowdown in China and Europe.

Let’s dive into the key economic data and market movements.

🇮🇳 The India Story: Inflation Vanishes, Policy Responds

This week’s data was dominated by a stunning inflation report that has electrified discussions about the Reserve Bank of India’s (RBI) next move.

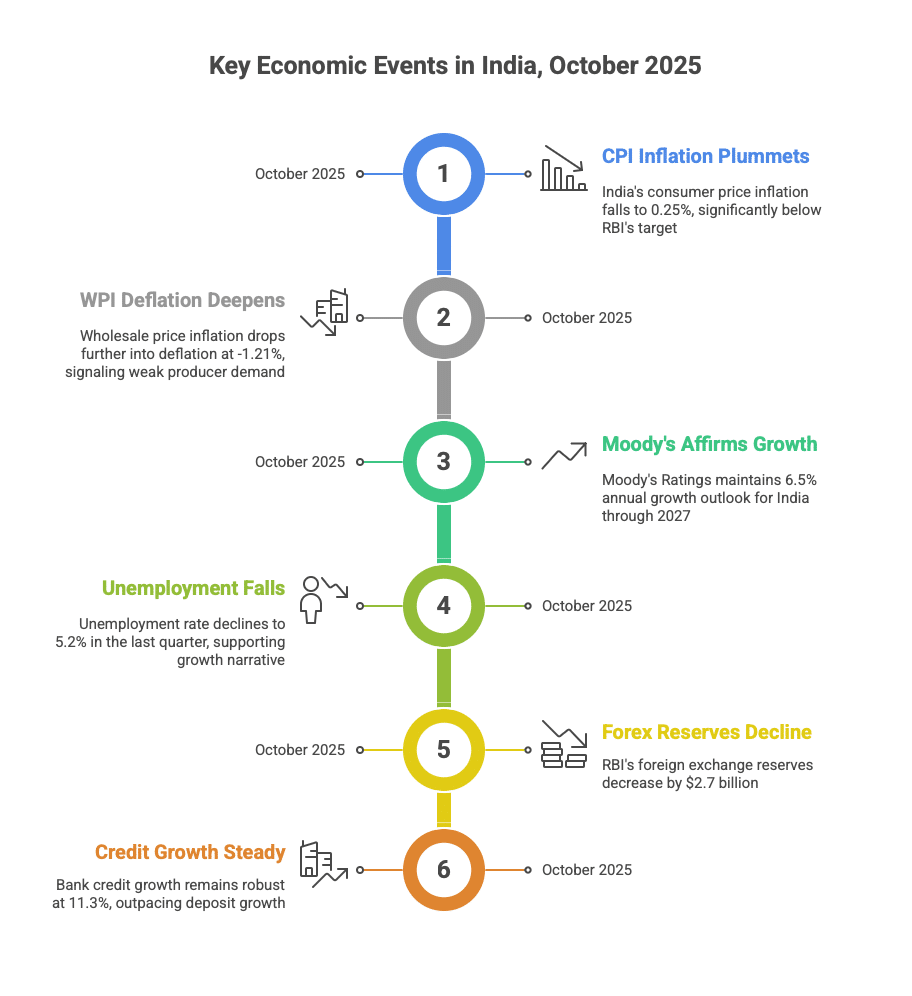

- Inflation Cooldown: India’s consumer price inflation (CPI) rate fell dramatically to just 0.25% in October. This is a sharp drop from September’s 1.44% and brings inflation significantly below the RBI’s target range, opening up considerable room for policy action.

- Producer Price Deflation: In parallel, wholesale price inflation (WPI) fell deeper into deflation at -1.21%. This signals weak demand and pricing power at the producer level.

- Stable Growth Outlook: Despite the mixed signals, Moody’s Ratings affirmed its long-term view, expecting the Indian economy to grow by a robust 6.5% annually through 2027. This was supported by data showing the unemployment rate fell to 5.2% in the last quarter.

- Forex & Credit: The RBI’s foreign exchange reserves saw another drop, falling by $2.7 billion. Meanwhile, bank credit growth remains steady at 11.3%, continuing to outpace deposit growth.

In response to the challenging global economic landscape, Indian policymakers were highly active. The government announced a massive Rs 45,000 crore export support package and a new Export Promotion Mission to counter US tariffs. It also protected domestic industry with an anti-dumping duty on Vietnamese steel while boosting innovation with a new AI centre and 1,000 e-buses for Pune. On the regulatory side, the RBI provided relief for exporters while SEBI issued a strong warning against unregulated “digital or e-gold” products, enhancing consumer protection.

🇺🇸 The US Picture: Resilient Consumer, Stable Labor Market

Data from the United States painted a picture of an economy that is defying the sharper slowdowns seen elsewhere, thanks to the consumer.

- Consumer Spending Rebounds: After a dip in September, October retail sales rebounded, rising 0.6% from the previous month and a solid 5.0% year-over-year. This was driven by a surge in online spending as holiday shopping began.

- Stable Labor Market: The labor market remains a pillar of strength. Estimated initial jobless claims for the week ending November 8th held steady at around 227,500. This stability continues to support wage growth and consumer spending.

- Underlying Caution: Despite strong sales, sentiment slipped, with the NFIB Small Business Optimism Index falling to 98.2, suggesting some underlying caution.

🌏 Global Headwinds: China’s Stall, Europe’s Stagnation

In sharp contrast to the US, concerns from the global front intensified, particularly from China.

- China’s Slowdown Deepens: A slew of data from Beijing points to a faltering recovery.

- Industrial Production growth slowed significantly to 4.9% (YoY) from 6.5% in September.

- Retail Sales also eased to a 2.9% rise.

- Fixed Asset Investment was a major concern, decreasing by -1.70%.

- The property market remains weak, with new home prices falling 2.2%.

- Europe’s Mixed Bag: The Eurozone economy expanded 1.4% in Q3, a slight moderation. While the trade surplus widened, the overall picture remains one of sluggish growth.

- UK Facing Trouble: The UK economy also slowed to 1.3% growth in Q3. More worryingly, its unemployment rate rose to 5.0%, the highest since 2021, coupled with a sharp 2.5% fall in industrial production.

📈Millionsworth View: Rate Cut Hopes vs. Global Reality

Here’s how financial markets digested this flurry of global economic landscape data:

Equity Markets: Indian indices snapped a two-week losing streak, with the Nifty 50 and Sensex gaining nearly 2%. The rally was fueled by domestic optimism from the record-low inflation print, which sparked hopes for an RBI rate cut.However, gains were capped on Friday as hawkish comments from US Federal Reserve officials dampened global sentiment, hitting rate-sensitive sectors like IT stocks.

The global slowdown and hawkish US stance introduce volatility, especially for export-linked sectors (like IT). Focus on defensive sectors (Pharma, FMCG) and high-quality Value stocks that are domestically focused and less sensitive to global trade wars.

Debt Market: The Indian bond market was the center of attention. The record-low 0.25% CPI data sent rate cut expectations soaring, pushing the 10-year government bond yield down to a three-week low of around 6.5%. The rally was kept in check by sticky core inflation figures and liquidity-draining operations by the RBI.

Record-low CPI data strongly supports an RBI rate cut. Long-duration funds may see tactical gains as yields fall post-cut. However, limit exposure due to core inflation risks and uncertainty over the RBI’s pace of easing. A “barbell strategy” (investing in very short and very long-term bonds) is advisable.

Commodities (Gold & Silver): It was a volatile week for precious metals. Gold and silver prices surged mid-week on global growth concerns. However, this rally reversed sharply by Friday. Both metals saw significant profit-booking as a strengthening US dollar and the end of the US government shutdown reduced their “safe-haven” appeal.

Despite the sharp profit-booking this week, gold’s fundamental role as a global hedge against economic uncertainty and trade tensions remains intact. Maintain a strategic allocation (5-10% of portfolio) to guard against potential global recession risks or a prolonged US-China trade war.

The Week Ahead

This week’s global economic landscape paints a picture of stark contrasts. India is now grappling with the new reality of near-zero consumer inflation, while the US is showing resilience. Both stand against the backdrop of a slowing China and a troubled UK.

For markets, the narrative is a clear tug-of-war: domestic good news (low inflation, potential rate cuts) is battling global bad news (a hawkish Fed, weak demand). The government’s active support for exporters is a clear admission of the challenges ahead. The key question now is whether the RBI will act on the plunging inflation or if the global headwinds will force a more cautious stance.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Please consult with a qualified professional before making any investment decisions.