The final week of October 2025 presented a mix of steady growth, policy continuity, and cautious optimism across global markets. Investors tracked key updates from central banks, moderating inflation in the Eurozone, and the Federal Reserve’s rate cut — all while India maintained its growth leadership among major economies. The global economic landscape reflected a phase of “soft landing” consolidation — with equities balancing earnings optimism, bonds adjusting to policy shifts, and commodities reflecting geopolitical caution.

India: Growth Resilient, Policy Momentum Strong

India’s economy continued to display resilience, with Chief Economic Advisor V. Anantha Nageswaran projecting growth of over 6.7% for FY2025–26, as earlier slowdown concerns eased. The IMF reaffirmed its estimate of 6.6%growth for 2025–26, keeping India among the fastest-growing major economies.

However, the RBI’s foreign exchange reserves declined by $6.92 billion to $695.36 billion for the week ended October 24, reflecting valuation changes amid a stronger U.S. dollar.

Policy activity remained strong. The government announced plans to introduce a new Seed Law in early 2026, approved a ₹37,952 crore fertiliser subsidy, and sanctioned an 8th Central Pay Commission to review pay scales. The UP government cleared ₹2,600 crore worth of logistics and warehousing projects, and Odisha approved ₹1.46 lakh crore in new investments.

Regulators stayed active: SEBI launched a major recruitment drive (110 posts), extended timelines for the optional T+0 settlement cycle, and proposed incentives for retail debt participation. The RBI reiterated its commitment to the 4% inflation target and took a measured stance on the Digital Rupee, prioritising stability over speed.

🌎 Global Updates

The U.S. Federal Reserve reduced rates by 25 bps to a 3.75%–4.00% range — its second cut in 2025 — citing progress on inflation. The Chicago PMI improved to 43.8 (from 40.6), suggesting tentative industrial recovery, even as pending home sales declined 0.9% in September.

Across Europe, the ECB kept rates unchanged for the third consecutive meeting, reflecting confidence in soft-landing progress. The Eurozone economy expanded 1.3% YoY in Q3, while inflation eased to 2.1% — near target. Business sentiment indicators improved modestly, with the Economic Sentiment Index rising to 96.8.

In Asia, China’s manufacturing PMI slipped to 49.0, indicating mild contraction, while non-manufacturing PMI rose slightly to 50.1. Japan’s industrial production rebounded 3.4% YoY, supported by a recovery in retail sales (+0.5%)and stable unemployment (2.6%), though housing starts fell 7.3%.

🧭 Millionsworth View

Equity Market: Equities globally ended the week on a mixed but steady note. The U.S. Fed’s 25 bps rate cut reinforced hopes of a soft landing, while corporate earnings in the U.S. and Europe remained largely resilient. The Eurozone’s inflation easing to 2.1% improved risk sentiment, even as China’s PMI data stayed weak, reflecting uneven growth in Asia. In India, domestic equities consolidated after strong quarterly earnings, and foreign inflows could strengthen if global liquidity improves in Q4. The long-term narrative of India as a growth outlier remains intact, supported by fiscal discipline and robust consumption.

Debt Market: Global bond yields declined after the Fed’s dovish guidance. The U.S. 10-year Treasury yield fell to 4.10%, its lowest level in two months, as investors priced in further policy easing in 2026. In India, the 10-year Government Security (G-Sec) yield held near 6.53%, supported by steady domestic demand and expectations that the RBI may extend its pausethrough FY26. The relative yield spread between Indian and U.S. bonds continues to attract selective foreign participation. Investors with a 2–4 year horizon can consider short-duration or target maturity funds to lock in yields amid a stable rate outlook.

Commodities (Gold & Silver): In commodities, precious metals remain firm amid global monetary easing and geopolitical tensions. Gold prices are trading around USD 4,003 per ounce, while silver hovers near USD 48.7 per ounce, up over 45% year-on-year. In India, 24-carat gold is priced near ₹12,300 per gram (≈ ₹1,23,000 per 10 grams), reflecting both global trends and rupee depreciation. The uptrend continues to be supported by central bank buying and strong ETF inflows. A 5–10% strategic allocation to gold and silver remains a prudent hedge against inflation, currency risk, and market volatility rather than a short-term return play.

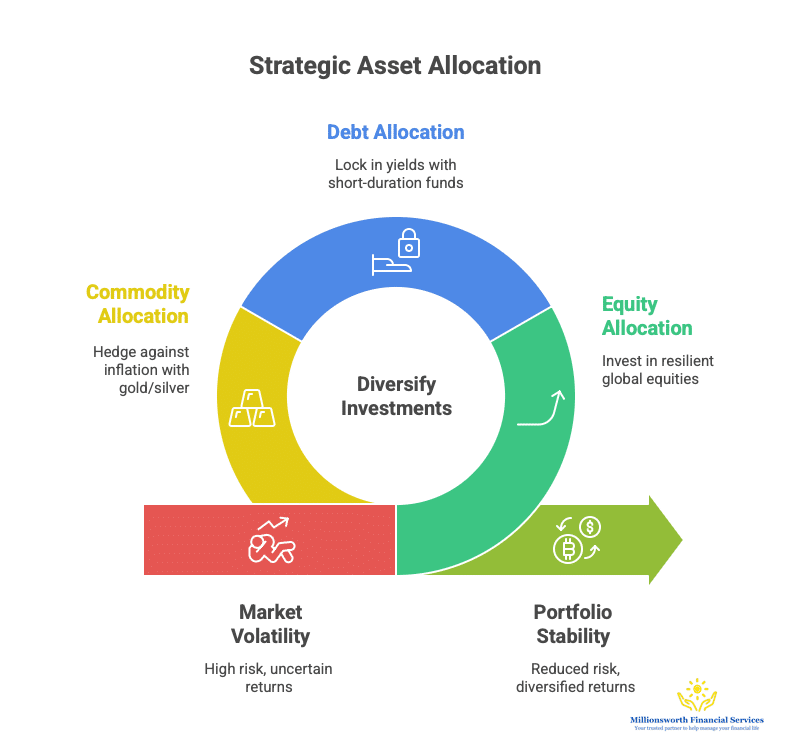

The week’s global economic landscape underscores a transition toward stability — slower inflation, measured policy responses, and steady consumption across regions. For investors, this phase calls for diversification and balance: maintaining equity exposure for growth, duration-managed debt for stability, and selective commodity allocation for risk hedging.