The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) concluded its meeting today, delivering a widely anticipated “dovish pause.” This strategy holds the current rate steady while clearly signaling a readiness for future easing, driven by favorable domestic data.

The Core Policy Decisions

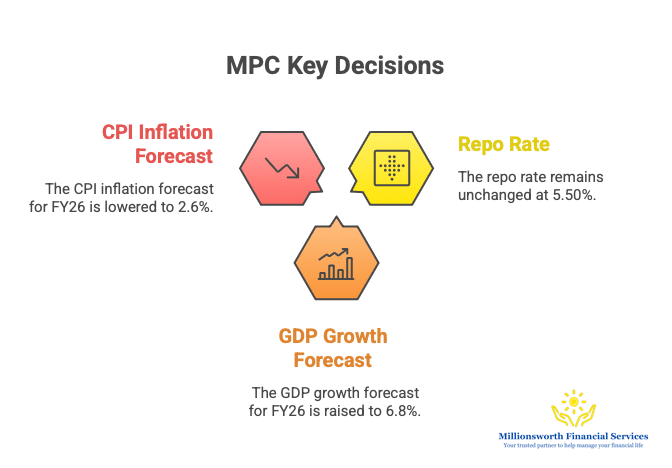

The MPC voted unanimously to keep the policy rate unchanged and maintained a Neutral Stance.

- Repo Rate: Unchanged at 5.50%.

- FY26 GDP Growth Forecast: Raised to 6.8% (from 6.5%), signaling confidence in domestic recovery driven by consumption and investment.

- FY26 CPI Inflation Forecast: Lowered significantly to 2.6% (from 3.1%), thanks to contained food prices and recent GST rationalization.

The downward revision in inflation by Monetary Policy Committee (MPC)—well below the 4% target—is the “dovish” signal, opening policy space for potential rate cuts in the near future.

💰 Your Money: Market-by-Market Impact

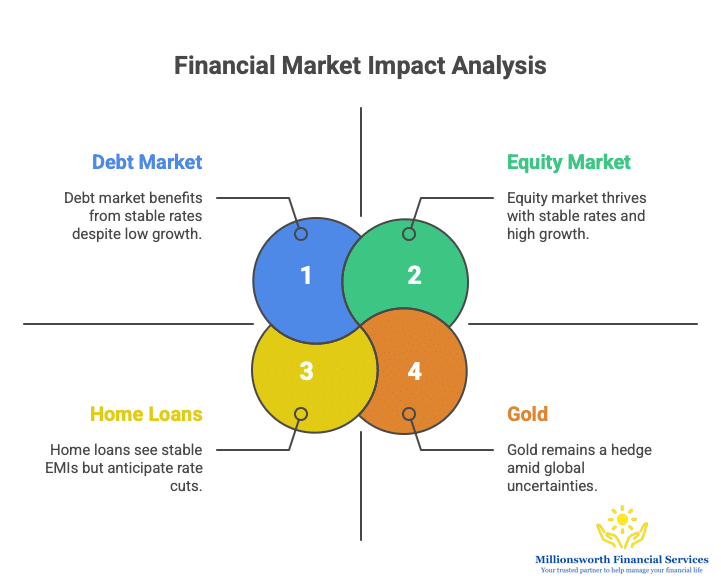

Equity Market: The outcome is a classic Goldilocks scenario—stable borrowing costs combined with a higher growth outlook. With a lower cost of capital and faster corporate earnings growth expected, the market is likely to maintain a bullish trajectory. Investors should maintain a “Buy on Dips” approach in rate-sensitive and consumption-driven sectors.

Debt Market: The sharp reduction in the inflation forecast suggests the rate-cutting cycle is paused, not over. This scenario is highly favorable for medium-to-long duration bond funds, as bond prices will rise when the policy rate cuts are eventually announced, likely in the next one to two quarters.

Home Loans (Floating Rate): For borrowers with floating-rate home loans (EBLR linked), your EMIs remain stable for now. However, the strong expectation of future rate cuts means your interest rates are likely to decline further. When the next rate cut occurs, plan to reduce your loan tenure instead of your EMI to maximize long-term savings.Gold: Low domestic inflation diminishes Gold’s role as a local hedge. However, persistent global trade uncertainties and geopolitical tensions continue to support its safe-haven demand. Maintain a strategic allocation to hedge against unforeseen global risks and potential Rupee depreciation.

The Investor Risk Landscape

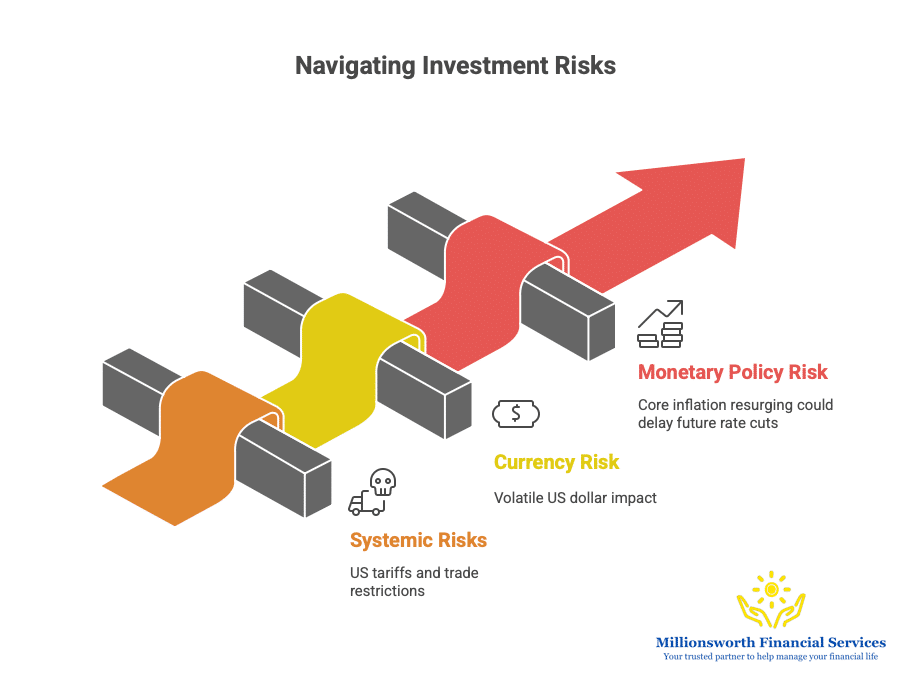

Bais Monetary Policy Committee (MPC) the domestic picture is bright, investors must be mindful of key risks. These include Systemic Risksfrom escalating US tariffs and global trade uncertainties, persistent geopolitical tensions, and potential Currency Risk due to a volatile US dollar impacting the Rupee. Domestically, the primary risk is Monetary Policy Risk: the possibility of core inflation resurging in the future (as projected for Q4 FY26), which could delay the market’s expectation of further rate cuts, leading to renewed volatility in the debt and equity markets.

The Monetary Policy Committee (MPC) has delivered a balanced policy, supporting growth while preserving flexibility. The economic environment remains conducive for growth, and the market consensus is that the next move from the RBI is overwhelmingly expected to be a rate cut.

Disclaimer: This is for informational purposes only. Consult your financial advisor for personalized strategies.